Term Life Insurance

Application Name: Term life insurance has its advantages when starting a

File Type = .Exe

Credit To @ www.pinterest.com

PDF Download

Open new tab

Application Name: Life Insurance, Get online term life insurance quotes

File Type = .Exe

Credit To @ www.pinterest.com

PDF Download

Open new tab

Application Name: Individual Life Insurance vs. Group Term Life Insurance

File Type = .Exe

Credit To @ www.pinterest.com

PDF Download

Open new tab

Application Name: Best Term Life Insurance Companies No Medical Exam Life

File Type = .Exe

Credit To @ www.pinterest.com

PDF Download

Open new tab

Application Name: Pin by Wenonah on What I do Life insurance agent, Term

File Type = .Exe

Credit To @ www.pinterest.com

PDF Download

Open new tab

Application Name: List of 51 Catchy Human Resources Slogans 50th, Career

File Type = .Exe

Credit To @ www.pinterest.com

PDF Download

Open new tab

Life insurance helps you plan ahead and provide long-term financial security for your family when they would need it most.

Term life insurance. Fidelity Investments Term Life Insurance (Policy Form Nos. Sementara asuransi jiwa whole life yang memberikan UP serupa mengenakan biaya premi sebesar Rp1 juta per bulan. Term life insurance is life insurance coverage designed to be purchased for a specific time period, typically between 10 and 30 years. Directed by Peter Billingsley.

Sebagai contoh, asuransi jiwa term life yang memberikan UP Rp1,5 miliar mengenakan biaya premi sebesar Rp300.000 per bulan. Life insurance quotes What is term life insurance? With an A+ rating from the Better Business Bureau (BBB) along with 5 out of 5 Power Circles on the J.D. Term life insurance offers level premiums for a specific period of time — generally 10, 20, or 30 years.

You can't put a dollar amount on your loved ones, but a term life insurance policy can help ensure their future is protected. Because term life insurance is purchased for a certain period, you often won’t have to pay for extra protection that you may not need. It is a simple life insurance product and usually the most affordable. Term life insurance provides death protection for a stated time period, or term.

Term insurance Plan are the only life insurance products that are especially designed to solve a sole purpose of protection. What is Term Life Insurance? A guy wanted around town by various hitmen hopes to stay alive long enough for his life insurance policy to kick in and pay out for his estranged daughter. Term life insurance, also known as pure life insurance, provides coverage during a specified length of time and guarantees the payment of a death benefit during that period.

A type of life insurance with a limited coverage period. Term life insurance pays a lump sum in the event of death or Total and Permanent Disability (TPD) if TPD benefit is provided.. Term life insurance is an affordable way to get maximum coverage throughout that time frame, and so is great for helping to cover specific financial responsibilities, such as paying for a mortgage or funding a. Term life insurance, typically available for ages 18 – 80, is the best fit for most families because it’s affordable and lasts for a set number of years before expiring.

It provides pure protection with no savings or investment features. Once that period or "term" is up, it is up to the policy owner to decide whether to renew or to let the coverage end. Since it can be purchased in large amounts for a relatively small initial premium, it is well suited for short-range goals such as coverage to pay off a loan, or providing extra protection during the child-raising years. With Term Life insurance, you can buy up to S$1.5 million of coverage without the need for a medical check-up if you are in the pink of health.

General Insurance– Also known as non-life insurance, general insurance is defined as any insurance that that doesn’t fall in the category of life insurance. Kemudian, biaya premi yang berlaku pada asuransi jiwa term life bersifat tetap pada periode tertentu dan akan. Term life insurance doesn't accrue cash value like several other types of life insurance, but with many term policies, beneficiaries do receive the full face amount. Why should one go for a whole life insurance plan?

Benefits of Term Insurance Plan. Term Life Insurance Offers an Affordable Option. For example, if a policy's face amount is $100,000, the beneficiary receives the full amount, pure and simple. Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified "term" of years.

The average monthly cost of life insurance is £19.83*, according to MoneySuperMarket data. And proceeds may help your family financially if the unexpected happens when they still have major expenses. It all sounds hunky-dory if you just draw a term insurance plan, but the question arises: Whole life is the most well-known and simplest form of permanent life insurance, which.

Term insurance is an affordable type of life insurance plan that, upon the demise of the policyholder with the specified term (period) of coverage, promises to pay a specific sum of money (sum assured) to the beneficiary. If the insured dies during the time period specified in the. The shortest term policy available is for one year, and you can typically buy policies with terms that last up to 30 years, or until you reach. Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term.

Life insurance includes term life insurance plan, whole life plans, endowment plans, money back plans, ULIPs, child Plans, investment plans and retirement plans. Power 2019 Life Insurance Study, State Farm is all about making sure clients are satisfied with their policies. Depending on the contract, other events such as terminal illness.

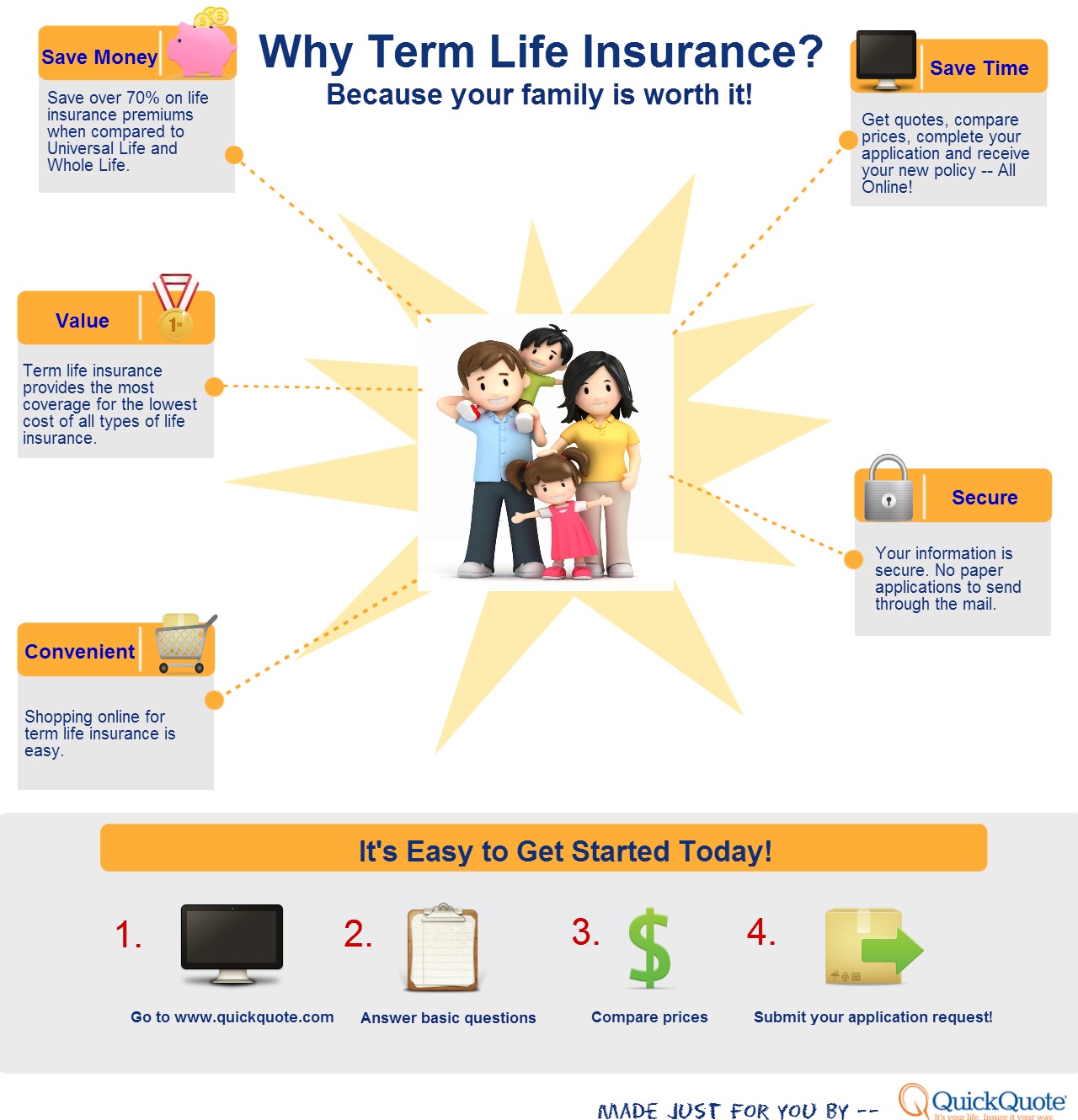

Application Name: Why Term Insurance Life insurance quotes, Term life

File Type = .Exe

Credit To @ www.pinterest.com

PDF Download

Open new tab