Term Life Insurance Quotes

Application Name: Pin by Ritikashah11998 on Life Insurance Life insurance

File Type = .Exe

Credit To @ za.pinterest.com

PDF Download

Open new tab

Application Name: Life Insurance, Get online term life insurance quotes

File Type = .Exe

Credit To @ www.pinterest.com

PDF Download

Open new tab

Application Name: MoneyTalkwithMelanie ItsYourMoney Term life insurance

File Type = .Exe

Credit To @ www.pinterest.com

PDF Download

Open new tab

Application Name: Life Insurance For Diabetics Affordable life insurance

File Type = .Exe

Credit To @ www.pinterest.com

PDF Download

Open new tab

Application Name: A Website PreLaunch Checklist Details (With images

File Type = .Exe

Credit To @ www.pinterest.com

PDF Download

Open new tab

Application Name: Difference between term and whole life insurance Insuran

File Type = .Exe

Credit To @ www.pinterest.com

PDF Download

Open new tab

Get a life insurance quote online or call us at (888) 532-5433 to get the assurance of knowing your loved ones will be protected.

Term life insurance quotes. Level term – gives you a fixed amount of cover for as long as the policy is in place. The longer your term, the more expensive your life insurance quotes can be. It provides just as much protection as a permanent policy, but it’s the cheaper option of the two. The premiums won’t be locked in anymore and rates will skyrocket, which is why most people cancel the policy after the term is up.

*Sample monthly life insurance rates based on Preferred health ratings for a 20-year term life insurance policy for a non-smoker male; No Exam Life Insurance; Unless it’s renewed, you will lose your coverage. Minus the bells and whistles.

It provides pure protection with no savings or investment features. With term life insurance you can get more death benefit for your dollar. IntelliQuote Term Life Insurance. It is a simple life insurance product and usually the most affordable.

Life insurance—specifically term life insurance—is the most affordable way to protect your family’s financial security if something were to happen to you. It's simple, low-cost coverage. Layering life insurance for full coverage Learn why a mix of group and individual life insurance policies may be a smart choice. Since it can be purchased in large amounts for a relatively small initial premium, it is well suited for short-range goals such as coverage to pay off a loan, or providing extra protection during the child-raising years.

Term Life insurance is designed for people who want coverage for a set number of years, normally 10-30 years. Term Life Insurance Offers an Affordable Option. So, someone who is on a tight budget can get more protection for their loved ones. Premiums stay level during the initial rate guarantee period.

Term life insurance is a policy that provides protection for a set number of years — such as 5, 10, 15, 20, 25 or 30 years. Term Life Quotes is owned by Eddie Levin, CLU, who is an independent insurance broker with over 40 plus years in the life insurance business. Annual Renewable Term 5 Year Term; The two types of term life insurance are level term and decreasing term.

If you outlive your term, your coverage effectively expires. A level term policy might be useful for paying off the outstanding capital on an interest-only mortgage, bills or other debts. Level premiums for 10, 15, 20, or 30 years Through GEICO Insurance Agency, Inc., Life Quotes, Inc.

The average monthly cost of life insurance is £19.83*, according to MoneySuperMarket data. Term life insurance pays a lump sum in the event of death or Total and Permanent Disability (TPD) if TPD benefit is provided.. Because term life insurance is purchased for a certain period, you often won’t have to pay for extra protection that you may not need. Find out what to expect when you apply for Term Life Insurance with Fidelity.

If you're concerned that your loved ones would struggle financially if you were to pass away unexpectedly, finding a term life insurance policy is an important step in providing for their future. Get an instant quote, and find out how much your can save on your term life insurance. Term life insurance is a simple and affordable way to provide financial protection for your family. Term life insurance offers level premiums for a specific period of time — generally 10, 20, or 30 years.

The following factors will determine the cost of your life insurance policy: Term life insurance provides death protection for a stated time period, or term. And proceeds may help your family financially if the unexpected happens when they still have major expenses. Term life insurance, typically available for ages 18 – 80, is the best fit for most families because it’s affordable and lasts for a set number of years before expiring.

4 important questions to ask about life insurance Learn why protecting yourself and your family against the unexpected is prudent. Term Life Insurance Quotes. We help you shop the market for the best possible policy at the best rate available. What a term life policy can include:

Offers affordable life insurance options to meet your family's needs. Term life insurance is a contract that guarantees coverage for a set amount of years. You'll receive a guaranteed death benefit for the term you choose, and your payments are guaranteed to remain level for the length of the term. The cost of life insurance can depend on the type of cover you choose (single or joint life insurance) and the term of the policy (level or decreasing term).Your monthly payments will also depend on the amount of cover you take out and your health and lifestyle.

Provides affordable coverage to meet your temporary needs. If you're looking for a life insurance policy, we've got you covered. Banner does not solicit business in NY. Banner products are distributed in 49 states and in DC.

Term life is designed replace lost earnings of a family breadwinner and is thus very popular among parents. Quotes based on policies offered by Policygenius in 2020.

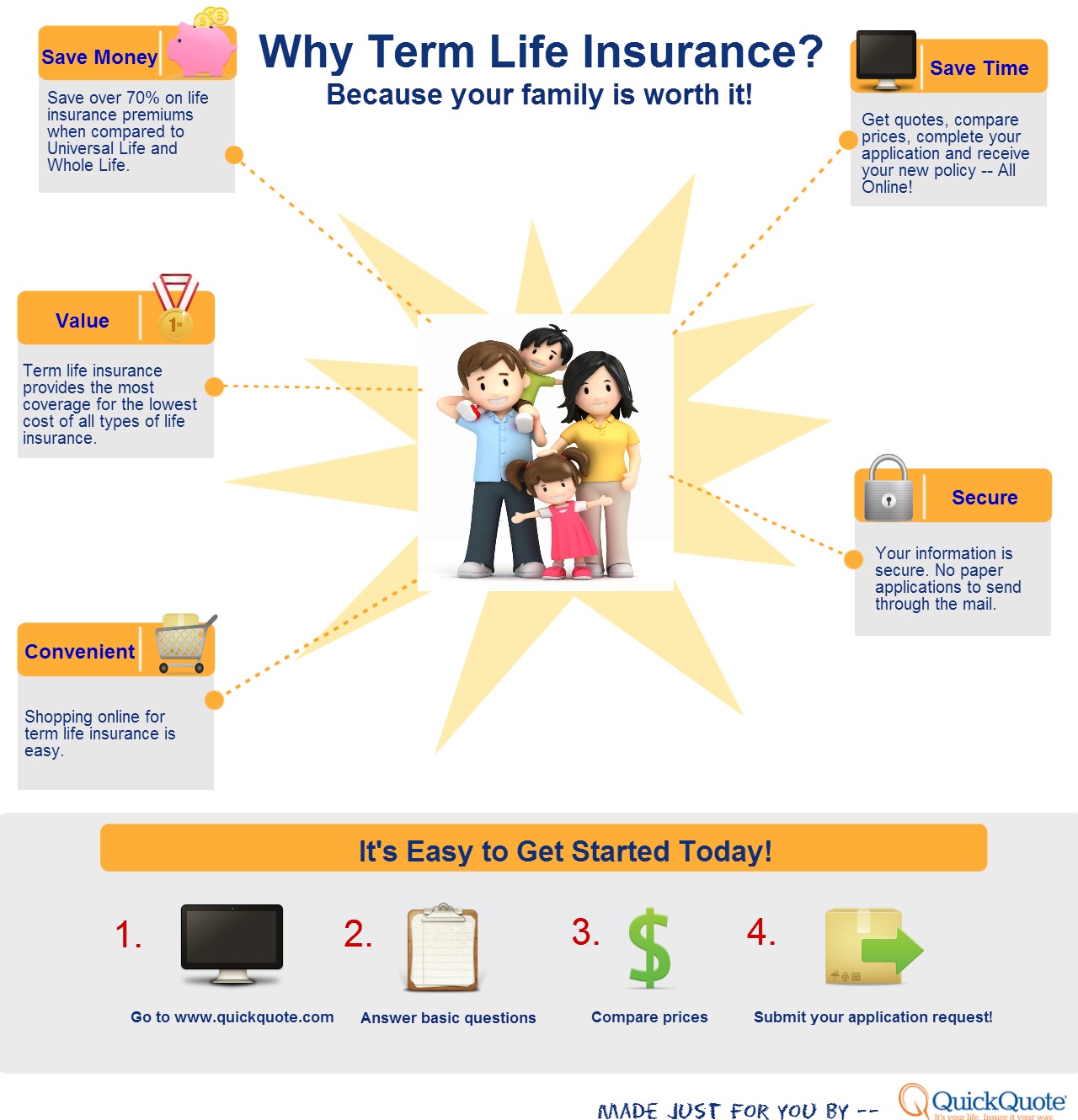

Application Name: Why Term Insurance Life insurance quotes, Term life

File Type = .Exe

Credit To @ www.pinterest.com

PDF Download

Open new tab